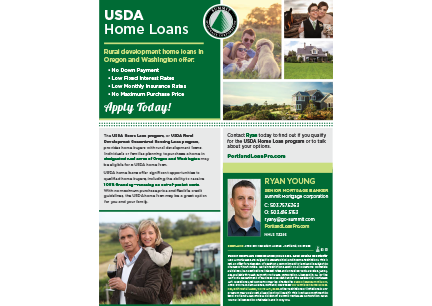

Ryan Young

SENIOR MORTGAGE BANKER

Portland Loan Pro NMLS 113296

C: 503.757.6263 | O: 503.416.5153

ryany@go-summit.com

Summit Mortgage Corporation | NMLS 3236

Meet Ryan Young

I’ve been with Summit Mortgage Corporation since 2007 and originating mortgages since 2003. I grew up in Eugene and attended Oregon State University, graduating in 1998 with a degree in Business Management. In my free time, I enjoy golfing, fly fishing, and following Beaver’s sports.

I’m licensed in Oregon and Washington. I make it my priority to treat my clients fairly, while taking the time to help them make the smartest financial decisions. Being a part of the Summit Mortgage Corporation team allows me to offer a wide range of programs and fund most loans as a direct lender, using our mortgage bank.

My specialty and focus is to educate my clients. I’ve worked with many first-time home buyers, as well as experienced homeowners and investors.

Purchasing A Home

Your dream home is at your fingertips. Whether you’re buying a home for the first time or looking for the perfect vacation home, we’ll help find the financing option that’s right for you.

Need To Refinance?

Saving money is good. Refinancing can help you obtain a lower interest rate, leverage your home’s equity, or simply lower your monthly payments. Let’s find a refinance solution and make it happen! Capitalize on these low rates.

Niche Products

We offer a wide array of niche products, as well as mortgage loans for manufactured and modular homes, properties with large acreage, Washington State bond programs, low-interest second mortgages, future income programs, extended lock options, and more.

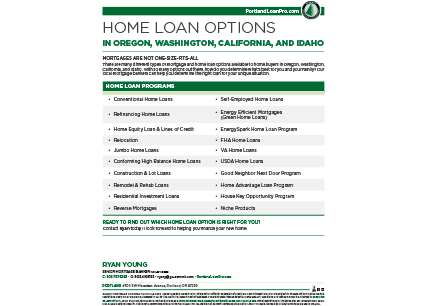

Loan Options

Purchasing or Refinancing in Oregon or Washington?

Look no further. I have a wealth of knowledge on a wide range of financing options. Here are just some of the home loan programs I specialize in:

- Conventional Home Loans

- Fixed & Adjustable Rate Mortgages

- Refinancing Home Loans

- Relocation

- Jumbo Home Loans

- Conforming High Balance Home Loans

- Construction & Lot Loans

- Remodel & Rehab Loans

- Residential Investment Loans

- Reverse Mortgages

- Self-Employed Home Loans

- Energy Efficient Mortgages (Green Home Loans)

- EnergySpark Home Loan Program

- FHA Home Loans

- VA Home Loans

- USDA Home Loans

- Good Neighbor Next Door Program

- Home Advantage Loan Program

- House Key Opportunity Loan Program

- Niche Products

Learn more about available loan options and apply today!

Testimonials

Thank you so much, Ryan and team! Couldn’t have asked for a smoother process.

Ryan Young exceeded our expectations! He truly was the one person that held my hand through the whole home buying process. I had a million questions and he was always happy to answer! I will recommend him to everyone I know and if we ever think about buying another home he will be the first person I call! Thank you, Ryan!

Ryan Young is incredibly knowledgeable and always on top of things. What a great guy!